Unlock Market Insights with Financial Data Web Scraping

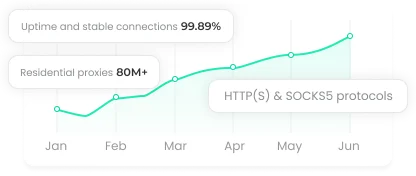

Stock market trends, currency shifts, corporate financials, and market indices—they’re the lifeblood of every analyst, investor, and business strategist. However, manually gathering this information is no longer enough. The sheer volume of data is exploding, and in a fiercely competitive landscape, speed is everything. A missed insight for even a few minutes can cost millions. Enter financial data scraping—a game-changer that delivers accurate, up-to-date information automatically. This isn’t just about running scripts. Done correctly, it’s a full-scale system that fetches data effortlessly, giving you the competitive edge without breaking a sweat.

What Is Financial Data Web Scraping

At its core, financial data web scraping is the automated extraction of information from relevant websites. These can include:

Stock trading platforms

Financial news outlets

Quote aggregators

Corporate investor portals

Scraping can be accomplished using programming scripts or specialized software with user-friendly interfaces. It doesn't just pull raw numbers—it turns complex data into actionable insights ready for analysis.

What You Can Scrape

The types of financial data you can capture are broad and highly valuable:

Currency and cryptocurrency rates: Track fluctuations and optimize trading or conversion strategies. Sources include central banks, exchanges, and converters.

Stock quotes and indices: Spot trends, monitor volatility, and make informed trading decisions in real time.

Corporate financials: Revenue, profit, P/E ratios, EBITDA, and debt figures—scraped from platforms like Yahoo Finance, EDGAR, or official business registries.

Economic and corporate news: Headlines and articles help predict market sentiment and identify drivers behind price changes.

Social media insights: An increasingly popular method for assessing market sentiment and anticipating trends.

Why Automated Scraping Beats Manual Collection

Speed, accuracy, and consistency are the hallmarks of automation. Compare that to manual data gathering: it's slow, prone to error, and inconsistent. Automated scraping ensures that the data is:

Retrieved instantly

Free from human errors

Organized systematically

Ready for immediate analysis

In short, it turns mountains of information into digestible, actionable intelligence.

Where Web Scraping Shines

Financial data scraping isn't limited to investors. Its applications stretch across industries:

Banking Analytics: Credit institutions analyze portfolios, overdue payments, and risk by segment. Automated scraping informs interest rates, lending policies, and scoring models in near real-time.

E-commerce: Online merchants monitor competitors' prices, update their own automatically, and optimize margins. Scraping informs procurement, logistics, and dynamic pricing strategies.

Financial Consulting: Consultants instantly access sector statistics, perform market valuations, and generate comprehensive reports for clients. This streamlines investment justification, M&A assessment, and strategic roadmaps.

Payment Operations: Competitor fee tracking allows companies to create competitive pricing, retain clients, and respond swiftly to market shifts.

Techniques for Scraping Financial Data

The method you choose depends on website structure, security measures, and data volume:

HTML Parsing: Extracts data directly from page code using CSS selectors. Ideal for static sites.

API Integration: Pulls structured data from platforms offering official APIs. Efficient and reliable.

JavaScript Parsing: Handles dynamic pages that load content after interaction. Headless browsers like Selenium or Puppeteer are key.

No-code/Low-code Tools: Visual interfaces that allow scraping without programming knowledge. Tools like Octoparse or ParseHub make this possible.

Proxies, IP rotation, random delays, and User-Agent switching help mimic real user activity and bypass anti-bot protections.

Scraping with Python

Python is a powerhouse for financial data automation. With its vast library ecosystem, you can extract, organize, and visualize data seamlessly. Some essentials include:

requests: Fetch HTML from web pages.

BeautifulSoup and lxml: Parse HTML and locate the elements you need.

pandas: Organize data into tables and perform calculations.

yfinance: Fetch stock quotes, trading volumes, dividends, and other financial metrics.

Scrapy: Advanced framework for large-scale, scalable scraping and database integration.

Python allows both individual investors and corporations to implement custom, powerful scraping pipelines.

Top Tools for Non-Programmers

You don't always need to code. Several tools offer a visual interface for financial data scraping:

Octoparse: Beginner-friendly, with ready-made templates for popular sites.

ParseHub: Handles dynamic pages and scenario-based extraction.

Apify: Offers cloud scalability, proxy systems, and API access for real-time competitor tracking.

These tools accelerate deployment while coding provides deep customization.

Legal and Ethical Considerations

Scraping isn't just technical; it's ethical and legal. Many sites forbid automated access in their Terms of Use. When possible, use official APIs—they're legal and designed to handle automated requests safely. Always respect data ownership and server load limits.

Conclusion

Financial data scraping is a necessity for today's fast-moving markets. When done ethically and strategically, it reduces manual effort, cuts costs, and gives businesses a competitive edge. Whether you're a Python enthusiast or a non-technical professional, scraping equips you with the insights to act faster, smarter, and more decisively.