How to Collect Data That Actually Matters

If your business isn't collecting data, it's flying blind. Simple as that. Data fuels smart decisions, powers innovation, and unlocks insights into what your customers really want. But collecting the right data? That's where most get stuck.

Let's cut through the noise. This guide breaks down what data collection truly is, explores practical methods you can apply today, and reveals the common pitfalls to avoid. Ready to sharpen your data game? Let's dive in.

Introduction to Data Collection

At its core, data collection is gathering pieces of information — lots of them — from different places and turning that raw chaos into something useful. Think of it as mining nuggets from a mountain of rocks.

Here's what that means in practice:

Aggregating from Multiple Sources

Data doesn't live in one place. It comes from websites, surveys, interviews, reports, even social media. Sometimes you scrape it automatically with software. Other times, it's hand-collected. The key is pulling it together strategically.

Collecting Unique Data Points

Each data point tells a tiny story — like a single price tag or a customer's feedback. Alone, it's just a number or a comment. Together, these points paint the full picture.

Turning Raw Data into Actionable Insights

Raw data? It's messy. Tons of irrelevant noise hide in there—HTML tags, outdated info, you name it. The goal: clean it up, parse it carefully, and turn it into clear, readable info that drives decisions.

Types of Data You’ll Encounter

Not all data wears the same hat.

Quantitative Data answers "how many?" or "how much?" Think: sales numbers, website visits, or product prices. These are measurable and crunchable.

Qualitative Data dives into the "what kind?" and "why?" — opinions, feelings, descriptions. It's less about numbers and more about context.

For the best results, blend both. For example, knowing that 70% of customers prefer a feature (quantitative) paired with why they love it (qualitative) gives you a complete story.

Primary Data Collection

This is data you gather yourself. It's fresh, specific, and tailored—but it takes effort.

Popular Methods:

In-Person Interviews

You get rich, nuanced feedback. Plus, body language and tone add layers of meaning. Perfect for local businesses wanting honest customer insights.

Online Interviews and Surveys

Scale up fast. Reach hundreds or thousands with a few clicks. Plus, the data lands digitally, ready to analyze. Great for product feedback and market research.

Phone Interviews

A middle ground—personal touch without face-to-face. But beware: success hinges on how warm your calls are. Cold calling? Prepare for low response rates.

Mail Surveys

Ideal for older demographics wary of online tools. Pair with incentives like coupons to boost replies.

Secondary Data Collection

When you don't need to reinvent the wheel, secondary data comes in handy. It's cheaper, faster, and sometimes richer than primary data.

Where to Look:

Internal Sources: Company reports, sales figures, employee data. Sensitive stuff, so watch privacy concerns.

External Sources: Government databases, academic studies, publicly available web data.

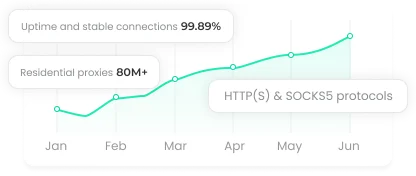

Use secondary data to spot trends, benchmark performance, or validate your primary research.

Real-World Techniques That Work

Structured vs. Unstructured Interviews

Structured follows a script. Quick and consistent. Unstructured lets respondents talk freely, revealing unexpected insights.

Delphi Method

Tap a panel of experts. Gather their answers anonymously. Repeat until you reach a consensus. Brilliant for forecasting or complex decisions.

Projective Methods and Word Associations

Great for marketing. Get into people's subconscious to understand brand perceptions or ad impact.

Focus Groups

Small, motivated groups discuss a topic together. The social dynamic often uncovers deep insights you won't get from surveys.

Role Playing

Put participants in hypothetical situations. Watch how they react. This reveals underlying attitudes and decision-making patterns.

How to Avoid Pitfalls

Don't chase data for data's sake. Be clear on what questions you're answering.

Clean your data rigorously. Garbage in = garbage out.

Choose the right method for your goal. A large-scale survey won't replace a deep-dive interview, and vice versa.

The Bottom Line

Data collection is not just a box to tick. It's your strategic advantage. By carefully selecting what, how, and where you collect data—and by knowing its strengths and weaknesses—you'll build smarter products, understand your audience better, and stay ahead of the curve.