How to Use Web Scraping to Collect Stock Market Data

In other blog posts, we have explored data scraping topics with broad appeal. But in this post, we will delve into the more niche area of stock market data scraping, which typically serves a smaller group of professionals. If you're interested in web scraping projects related to financial instruments, read on!

Getting to Know Web Scraping

Web scraping involves collecting extensive data from a predefined list of sources or websites. If a company has a detailed database on a particular demographic, scraping it for specific data can provide accurate and valuable insights that can be used in various ways.

Data scraping is not only valuable for commercial and marketing firms; it is also highly profitable for stock data acquisition. In the investing world, stock data is crucial and can provide investors with insights into:

· Market trends

· Price movements

· Real-time information

· Investment opportunities

· Price forecasts

Web scraping stock data can be complex, but when done right, it can yield excellent results. It provides investors with essential insights into various market factors, helping them make informed investment decisions. By scraping price data, companies can collect publicly available information that is crucial for data-driven strategies.

Steps in the Data Scraping Process

Generally speaking, scraping stock data involves three main steps.

First, identify the data sources by determining the type of stock data you need and locating the appropriate websites. Once you have the URLs of these sites, you need to send GET requests to them. Next, specify the exact characteristics of the data you want in your GET requests to ensure that the scraper can collect the information accurately. Clearly defining these details helps the scraper retrieve the necessary data effectively.

The second step is parsing, which involves structuring the data you've collected. Typically, this data will come in HTML or XML formats, which aren't directly suitable for analysis. To make the data usable, you need to convert it into a structured format, such as a tree structure. For instance, the Python library Beautiful Soup is commonly used to transform HTML or XML documents into organized, structured data.

Finally, store the structured data in a format that is easy to work with, such as CSV, Excel, or JSON. These formats will enable you to perform data analysis and processing to extract valuable insights about the financial market.

Advantages of Stock Market Scraping for Businesses

Businesses can leverage web scraping for various purposes, including collecting user information, analyzing economic trends, and gathering stock market data. Investment firms, in particular, use web scraping tools to acquire detailed data needed for detailed assessments before investing in specific stocks.

Safely investing in the stock market is far from simple. The market is complex and influenced by numerous volatile factors, each of which can unpredictably affect stock values. However, by analyzing these variables with accumulated data, it is possible to make investments considerably safer.

A highly effective approach to gathering large volumes of data is through stock market data scraping. This involves using a web or stock market scraper to extract extensive amounts of information from the stock markets.

This software automatically collects valuable data, which can then be parsed and analyzed to support informed and strategic investment decisions.

Where to Find Stock Market Data?

Professionals use various APIs to obtain stock data from the web. Google Finance was a commonly used tool in the past, but it has been deprecated since 2012.

Yahoo Finance is a popular choice for stock data, though its API has been unreliable at times, with periods of deprecation and revival. If Yahoo Finance isn't suitable for your project, several private companies offer alternative APIs for stock data. Additionally, stock exchanges and financial websites can also serve as valuable sources of information.

Tools for Stock Market Data Scraping

Investment firms and businesses aiming to boost their profits through stock market investments need to use specialized tools for stock data scraping. This process is not simple and involves utilizing various tools to gather data, eliminate inconsistencies and redundancies, and deliver usable, accurate information.

Python Programming

Python is a popular choice for scraping stock market data, thanks to its high-level programming capabilities, easy-to-understand syntax, and reliability. Its popularity is further enhanced by built-in libraries like Pandas, Selenium, and Beautiful Soup, which streamline and automate routine tasks.

Web Crawling Software

A web crawler typically uses a network of algorithms known as spiders to navigate finance websites according to predefined rules. While web crawlers and web scrapers are often confused and can work together, they serve different purposes. A web scraper is designed to extract data from specific targets, whereas a web crawler is focused on discovering and identifying targets, which can then be extracted or scraped.

Some providers offer standalone web crawlers with additional features, specifically designed for users with limited coding experience. These tools are generally straightforward to implement and user-friendly.

API

API is more advanced than a basic Python scraper or web crawling software, as it incorporates the strengths of both. It integrates a scraper, a crawler, and a parser. This allows you to simply request the data you need, and the API will provide the results in a structured format, such as JSON.

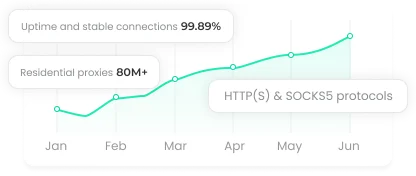

Importantly, Swiftproxy's API offers more than just basic features. With Swiftproxy's robust infrastructure, you won’t have to worry about maintenance or development. Plus, you'll benefit from cost efficiency by only paying for successfully delivered results.

Difficulties in Extracting Stock Market Data

As previously noted, web scraping is a complex process that involves executing a series of precise and timely steps to gather valuable information and data. Additionally, websites often implement measures to mitigate or prevent data scraping.

This is why many high-end companies prefer to develop their own tools, as various obstacles can disrupt the web scraping process. A common challenge in stock data scraping is blocked IP addresses, which can prevent the tool from accessing the necessary directories and result in no data being retrieved.

Many of these problems can be mitigated by developing the stock data scraper in-house and outsourcing resources like proxies. While some challenges are inevitable, a custom scraper tool enables businesses to navigate and bypass certain restrictions more effectively.

Dynamic Data Scraping

Given the stock market's high volatility and frequent fluctuations, using a dynamic data scraper is crucial. This tool collects, processes, and analyzes data as it happens, ensuring you have the most current information.

While dynamic data scrapers are more expensive than slower alternatives, they are ideal for investment firms or businesses requiring accurate, immediate information for rapid stock market transactions.

Final Summary

For any serious investment firm or company seeking to make informed stock market decisions, employing a scraper tool to collect stock market data is essential.

Scraping stock market data involves indexing multiple stock market websites and APIs, using a web scraper tool to extract the data, and then refining, analyzing, and applying the results.

For more information on data acquisition, please explore our other blog posts for additional insights into web scraping. We offer extensive resources on a variety of data collection techniques.